In the fast-paced world of entrepreneurship, managing your business finances efficiently is crucial for success. FreshBooks, an innovative accounting software solution, has emerged as a game-changer for small businesses and freelancers. In this article, we will explore the key features and benefits that make FreshBooks a go-to platform for simplifying financial management.

- User-Friendly Interface: FreshBooks is renowned for its intuitive and user-friendly interface. Navigating through the platform is a breeze, making it accessible for individuals without extensive accounting backgrounds. The dashboard provides a clear overview of your financial health, displaying key metrics at a glance.

- Invoicing Made Easy: One of FreshBooks’ standout features is its invoicing capabilities. Users can create professional-looking invoices, customize them to match their brand, and send them directly from the platform. The automated invoicing system saves time and ensures that you get paid faster.

- Expense Tracking and Reporting: Tracking expenses is simplified with FreshBooks. Users can easily categorize expenses, capture receipts using their mobile devices, and generate insightful reports. This feature not only facilitates budget management but also aids in making informed financial decisions.

- Time Tracking for Efficient Billing: For service-based businesses, accurate time tracking is essential. FreshBooks offers a built-in time-tracking feature, allowing users to log billable hours effortlessly. This information seamlessly integrates into the invoicing process, ensuring accurate billing for clients.

- Bank Reconciliation: FreshBooks connects directly to your bank account, enabling automatic synchronization of transactions. This streamlines the reconciliation process, reducing the likelihood of errors and providing a real-time view of your financial position.

- Multi-Currency Support: As businesses expand globally, dealing with multiple currencies becomes inevitable. FreshBooks addresses this challenge by offering multi-currency support, allowing users to invoice and track expenses in various currencies with ease.

- Secure Cloud-Based Platform: Security is a top priority for FreshBooks. The platform operates on a secure, cloud-based infrastructure, ensuring that your financial data is protected. Regular backups and encryption protocols provide peace of mind for users concerned about data integrity.

- Integration Capabilities: FreshBooks integrates seamlessly with a variety of third-party applications, further enhancing its functionality. Whether it’s connecting with payment gateways, e-commerce platforms, or customer relationship management (CRM) systems, FreshBooks offers a versatile solution that can adapt to your business needs.

How to Use FreshBooks:

1. Setting Up Your Account:

- Visit the FreshBooks website and sign up for an account.

- Complete your profile, including business details and preferences.

2. Navigating the Dashboard:

- The dashboard provides an overview of your business’s financial health.

- Access key features like invoicing, expenses, time tracking, and reports from the dashboard.

3. Creating Invoices:

- Click on the ‘Invoices’ tab.

- Choose ‘New Invoice’ and fill in client details, services provided, and rates.

- Customize the invoice template to match your brand.

4. Expense Tracking:

- Head to the ‘Expenses’ section.

- Add expenses manually or capture receipts using the mobile app.

- Categorize expenses for accurate tracking.

5. Time Tracking:

- Utilize the ‘Time Tracking’ feature to log billable hours.

- Associate tracked time with specific clients and projects.

6. Bank Reconciliation:

- Connect your bank account for automatic transaction synchronization.

- Regularly reconcile transactions to maintain accurate financial records.

7. Generating Reports:

- Explore the ‘Reports’ section for insights into your business’s performance.

- Generate profit and loss statements, expense reports, and more.

8. Integration with Third-Party Apps:

- Navigate to ‘Integrations’ to connect FreshBooks with other tools.

- Explore integrations with payment processors, e-commerce platforms, and CRMs.

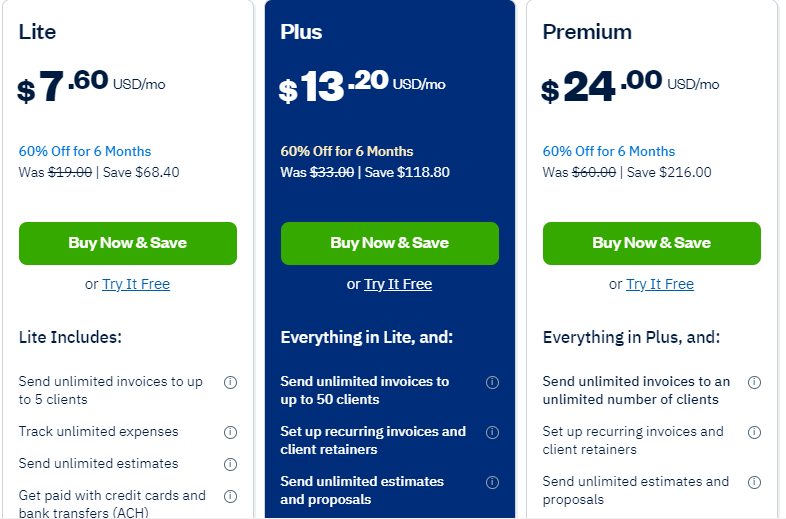

FreshBooks Pricing Plans:

FreshBooks offers tiered pricing plans to cater to different business needs. As of my last knowledge update in January 2022, the plans are as follows:

- Lite Plan:

- Suitable for freelancers and solo entrepreneurs.

- Invoicing, expense tracking, time tracking.

- Basic reports.

- Plus Plan:

- Geared towards small businesses.

- All features of the Lite plan.

- Proposals, recurring invoices, and client retainers.

- Advanced reports.

- Premium Plan:

- Ideal for growing businesses with a team.

- All features of the Plus plan.

- Team time tracking, project profitability tracking.

- Advanced reports.

- Select Plan:

- Customizable plan for large businesses.

- All Premium features.

- Dedicated account manager, personalized training.

Customer Feedback:

Positive Points:

- User-Friendly:

- Many users praise FreshBooks for its easy-to-navigate interface.

- Invoicing Efficiency:

- Users appreciate the streamlined invoicing process, leading to faster payments.

- Customer Support:

- Positive feedback regarding responsive and helpful customer support.

Areas for Improvement:

- Integration Limitations:

- Some users express a desire for more integrations with specific third-party apps.

- Advanced Features:

- Larger businesses may find limitations in advanced features compared to more comprehensive enterprise solutions.

Conclusion:

In conclusion, FreshBooks is more than just accounting software; it’s a comprehensive financial management solution tailored to the needs of small businesses and freelancers. Its user-friendly interface, robust features, and commitment to security make it a valuable asset for those looking to streamline their financial processes. Consider incorporating FreshBooks into your business toolkit to experience firsthand the efficiency and convenience it brings to managing your finances.